|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

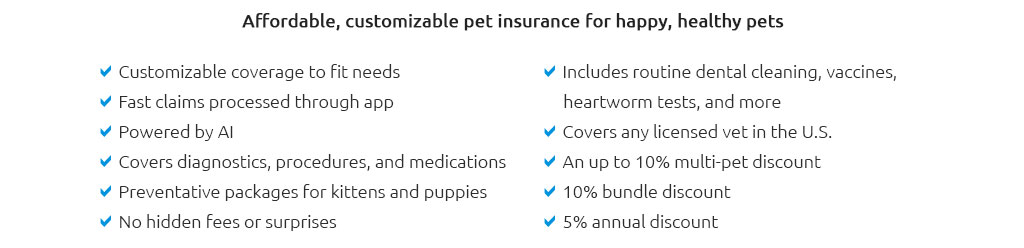

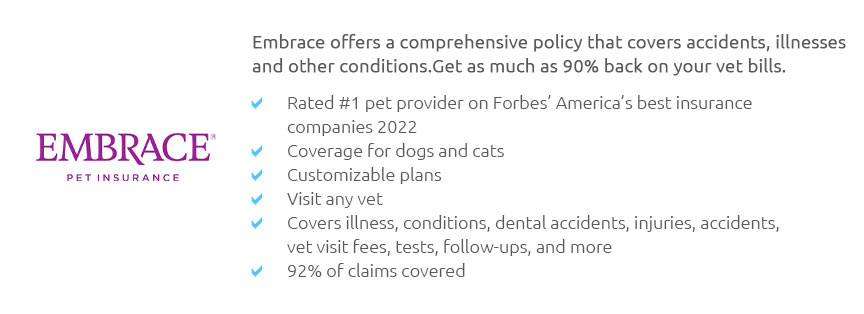

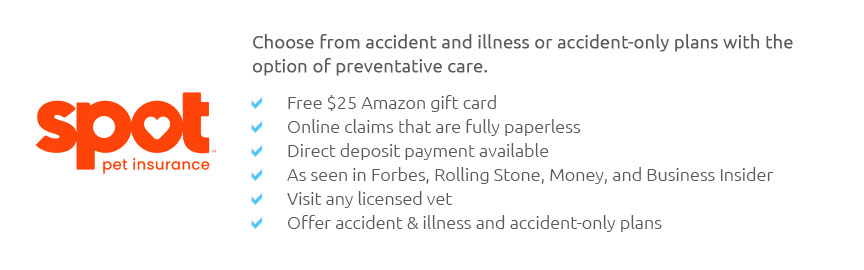

Understanding Medical Insurance for Pets: Important ConsiderationsIn recent years, the concept of medical insurance for pets has gained remarkable traction, reflecting a broader societal trend towards recognizing the integral role that animals play in our lives. As pet ownership surges, more individuals are seeking ways to ensure the health and longevity of their furry companions, propelling the pet insurance industry into the spotlight. Pet insurance, akin to human health insurance, provides a financial safety net against unexpected veterinary costs, which can be astoundingly high. With veterinary medicine advancing in leaps and bounds, offering sophisticated procedures and treatments, the expenses can be quite daunting. This brings us to a critical question: is pet insurance worth it? While opinions vary, a nuanced understanding of the benefits and limitations is imperative for making an informed decision. One significant advantage of pet insurance is its ability to provide peace of mind. Knowing that you can afford the best possible care in a crisis without the crippling burden of exorbitant bills is a compelling reason for many. Furthermore, insurance can encourage pet owners to pursue necessary treatments they might otherwise forgo due to cost constraints. However, it's essential to weigh these advantages against the policy's terms, which often include deductibles, co-pays, and caps on payouts. When considering pet insurance, several factors demand careful consideration. First and foremost is the type of coverage offered. Most plans cover accidents and illnesses, but there are also policies specifically for wellness care, which include routine check-ups and vaccinations. While comprehensive coverage might seem appealing, it's crucial to evaluate your pet's specific needs and health risks. For instance, certain breeds are predisposed to specific conditions, and this should influence your choice of policy. Another key aspect is the cost of the premiums. These can vary significantly based on factors such as the pet's age, breed, and location. Younger, healthier animals typically attract lower premiums, whereas older pets or those with pre-existing conditions may be more costly to insure. It's wise to obtain quotes from multiple providers and compare them meticulously, ensuring that you understand what is covered and, equally important, what is not. It's also worth noting the claims process, which can differ markedly between companies. Some insurers offer straightforward claims procedures with quick reimbursements, while others may require more documentation and longer processing times. Reading reviews and seeking recommendations from fellow pet owners can provide valuable insights into an insurer's reliability and efficiency. One often overlooked but vital consideration is the exclusions and limitations inherent in many policies. Pre-existing conditions are typically not covered, and there may be specific exclusions for hereditary or congenital issues, especially in purebred animals. Understanding these limitations upfront can prevent unpleasant surprises when attempting to file a claim. While some critics argue that pet insurance is an unnecessary expense, proponents contend that it represents a sound investment in your pet's health and your financial stability. Ultimately, the decision hinges on personal circumstances, including your financial situation, risk tolerance, and your pet's health profile. In conclusion, the decision to invest in pet insurance should be made with careful deliberation. It requires balancing the potential financial benefits against the cost of premiums and the scope of coverage. By conducting thorough research and considering your pet's unique needs, you can make a choice that offers both protection for your beloved companion and peace of mind for yourself. https://www.petsbest.com/

Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

MetLife, Embrace and Pets Best top our list of the best pet insurance companies. Many, or all, of the products featured on this page are from ... https://www.aspcapetinsurance.com/dog-insurance/

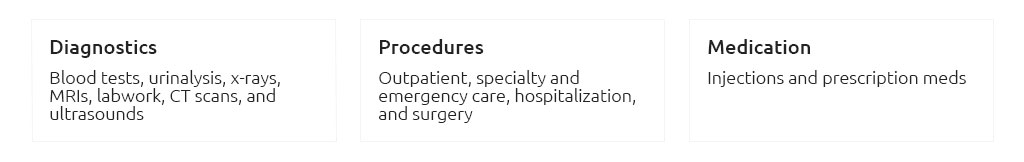

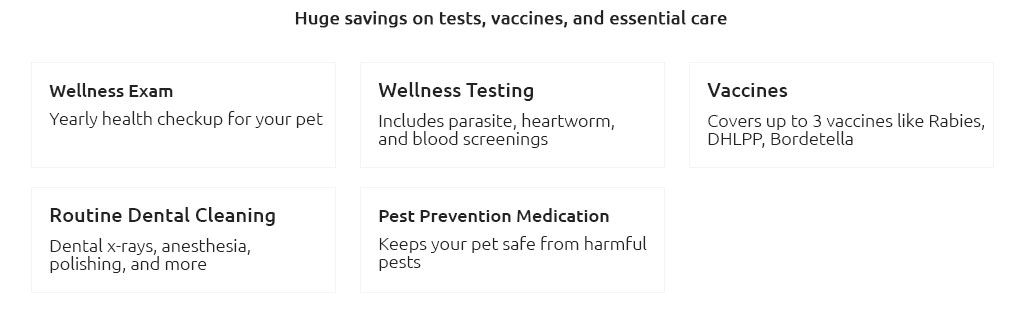

Complete Coverage SM for Dogs starting as low as $10/month. Complete Coverage SM plans cover Diagnostics Think X-rays, MRI, blood tests, urinalysis, ...

|